Inflation

“”There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. The process engages all the hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million is able to diagnose.

|

| —John Maynard Keynes[1] |

| The dismal science Economics |

| Economic systems |

| Major concepts |

| The worldly philosophers |

Inflation most simply is a growth in the money supply without an additional backing by product. Today, under fiat currencies, it's normally redefined as and measured by price levels using the Consumer Price Index (CPI) or core inflation, which is the CPI minus oil and food (as those commodities are more volatile). A small rate of inflation is the natural by-product of a growing economy. It was summed up by Milton Friedman as "too much money following too little goods."

Causes[edit]

Despite the Milton Friedman's famous statement that "inflation is always and everywhere a monetary phenomenon",[2] most economists today agree that inflation has many causes:

- Cost-push: Where supply-side effects create the rise in prices, such as, for example, a depleting metal rising in price, because the cost to extract each unit of metal rises as it becomes more scarce.

- Demand-pull: Where demand-side effects create the rise in prices, such as with fuel, where the newly industrialized East Asian countries need oil, and thus demand huge swathes of it too, raising overall demand for fuel from the industry, or where money is simply printed, leading to more spending with no concurrent rise in product, causing demand for the same number of products to rise, and thus raising prices also.

- Too large money supply compared to the economy: If the size of the money supply grows relatively larger than the value of economic activities, prices of the economic activities go up.

- Indirect taxes raising the prices of goods and services.[3]

- Trade barriers can also exacerbate inflation by reducing the supply of goods and giving firms more market power.[4] In 2022, Harvard economist Larry Summers argued that a reasonable tariff reduction in the United States could take more than 1 percent off the CPI.[5]

- Political instability: covering around 100 countries analyzed for the period 1960–99, an IMF working paper found that a higher degree of political instability generates higher inflation rates. Basically, government crises shorten the time horizon of the members of government, as they are not certain that they will keep their posts for long. The higher the probability of being replaced, the greater will the importance attributed to short-term objectives.[6]

Greedflation[edit]

Once fringe, the idea that inflation is caused by corporate price-gouging went viral on the Internet after the high inflation during the Covid-19 pandemic era. Some studies found that the high inflation during the period was caused by short supplies, not because companies found out after thousands of years that they can ask for higher prices without consequences.[7] Some studies found that there isn't even any evidence that corporates profited more during the period, in the UK[8] and there's evidence that taxes are more responsible than business for the high inflation.[9] According to a study, in America, at worst, the markup provides a signal that price setters expect persistent increases in their future costs of production. Or, in other words, corporates raised the prices because they expect the prices to increase.[10] Another study showed that there is no empirical support for a strong correlation between markup and price changes, and that companies that raised their prices the most weren’t necessarily the ones getting a larger profit margin.[11]

However, contradictory evidence suggests that up to 60% of inflation was driven by corporate price-gouging in 2021.[12] NPR goes onto raise the point that this could create a feedback loop. Corporations expect prices to raise as inflation increases, so they raise prices, increasing inflation.[12][13]

A 2023 IMF study showed that in 2015 profits actually contributed more for the Eurozone inflation than in 2022 and 2023, also arguing that the limited available data does not point to a widespread increase in markups, and that there is no evidence that would warrant substantial concerns or policy interventions in terms of competition policy. [14]

A study by the heterodox "Collective Groundwork" released in 2024 argued that half of recent American inflation was due to corporate profiteering.[15] According to this study corporations kept prices high even as "their inflationary costs drop."[15] Such study, however only studied a tiny period. NYU economist Chris Conlon used the same methodology used by the Collective Groundwork Group and showed that, if you look over a longer period, profits account for a rather smaller share of the increase in price rises in the past two or three years (again, if companies could raise prices at their will, why did they wait until 2020? And why did inflation wane in the following years?). Conlon also claimed that the way profits were measured by Groundwork is deeply flawed: they just use national accounts data to obtain what value-added goes to labor and other inputs, with the remainder ascribed to "profits". Such methodology, according to him “includes things like retained earnings which firms might use to invest or expand capacity. If this line item [profits] were zero, they'd never been able to expand or invest.”[16]

However, the Groundwork Collaborative study focused on inflation during the final two quarters of the last year,[15] so an argument could be raised questioning the relevancy of extending the metrics past the last two fiscal quarters.

Perhaps the largest study to date on the US pandemic-era inflation was conducted by Nobel Memorial Prize and former Federal Reserve chair Ben Bernanke with the MIT economist Oliver Blanchard. The study concluded that the strong inflation of 2021-22 largely reflected strong aggregate demand, the product of easy fiscal and monetary policies, excess savings accumulated during the pandemic, and the reopening of locked-down economies, not even mentioning greedflation.[17]

Macroeconomic role[edit]

Keynesian interpretation[edit]

Inflation is one of the core econometric gauges used by economists to measure an economy. In the 1930s-1970s Keynesian Era, it was general consensus among economists that unemployment mattered most - unemployed workers were effectively idle and thus wasting energy that could be used to produce, creating stagnation. However, the 1970s created a strange coexistence between high unemployment and high inflation, appropriately called "stagflation". This resulted in a paradigm shift in economics, whereby economic efficiency became a focus. It's all well and good to have 20% of your population staffed in the military, mining coal or producing crappy cars, but if nobody wants it, you're effectively paying people to spend money when the product they have created is valued much less, with the result being high inflation.

Monetarist interpretation[edit]

“”Negative rates are turning out to be a dirt sandwich, especially for Japan. They thought that that was going to get people out spending. And what happened is they got people to go and buy safes and put money into their safes and hoard money.

|

| —Karyn Cavanaugh, financial analyst[18] |

With this realization, economic policy since the 1970s has generally revolved around "inflation targeting", and has been termed Monetarism. Under this interpretation, the Great Depression resulted from deflation. As banks create money by investing out money invested into them, the bankruptcy of the banks' investments effectively causes the money supply to contract, creating deflation. As each unit of money buys more, people reduce spending, anticipating future spending potential—causing the economy to fall back to equilibrium. This is popularly termed a "market correction", as it forces less-liquid investments out of the economy, allowing investment in more liquid (and hence more efficient) assets. However, an issue with deflation is that in cases like the Wall Street Crash, people rushing to save causes more banks to crash, creating more demand for saving, and so on. This quenching of demand and causing more foreclosures is termed "deflation spiral".

Meanwhile, high inflation is interpreted as inefficiency in the economy. For example, from 2003-2007, the Sub-Prime Mortgage Bubble saw inflation rising far beyond the target rates. This was because of the vast sums of capital invested into the unproductive housing market, effectively raising prices without increasing other markets' income, effectively taxing productive industries and subsidizing the bubble. With economic growth slowing but inflation holding out, the central banks had to raise interest rates to curtail the supply of money and cut inflation, forcing an enormous economic correction. As deflation took hold, these corrupt, crony banks were then fed more capital to fight it. As corrupted stimulus spending joins this with held hands, inflation is once again rising, with unemployment not budging from impressively high heights.

Hence, too much inflation has the effect of taxing the productive to subsidize the less productive, creating deadweight loss through supply deficits, whilst negative inflation has the effect of putting a cap on demand and creating deadweight loss through demand deficits. Zero inflation is ideal as a state of equilibrium; however, economists generally agree that 1-3% inflation is a nice figure because consistent depreciation of currency creates elementary levels of demand, and reduces the likelihood of excess hoarding[18] of non-productive assets.

Austrian interpretation[edit]

Despite Monetarism only really being properly practised in Europe (aside from one country in particular failing spectacularly for unrelated reasons), in light of the recent mass failure of governments to alleviate the economic strife, people have presumed that it is intrinsically at fault, and alternative/unorthodox economic schools have risen to prominence, particularly the Austrian School. The Credit Cycle Interpretation proposed by Friedrich Hayek nearly mirrors the Monetarist interpretation (except that it proposes that deflation spirals do not exist, and are just a sharp return to equilibrium, and that state monetary policy is ultimately disequilibrate and inefficient, often because of back-hand deals by special interests). Almost all Austrian School Economists advocate the gold standard, claiming this would force inflation back out of the hands of corruptible people. This, however, would seem to fail as an alternative, as it presumes that the quantity of gold will be perfectly in line with true economic growth. This may have been true in the 1800s, where the effectiveness of gold mining was very closely in line with the rest of the economy's true productive output; but since the 1920s, economic growth in other areas has vastly outpaced the extraction of this metal. Not to mention that with its relatively new application in semiconductors, gold has followed silver in developing a genuine commercial value, rather than just being a store of value.

Hyperinflation[edit]

There is no technical threshold for hyperinflation, but economists usually follow the description by Phillip D. Cagan![]() which is 50% monthly inflation[19]. Hyperinflation tends to create a positive feedback loop where faith in the currency is lost so people spend as much as they can as fast as they can, driving prices up even higher.

which is 50% monthly inflation[19]. Hyperinflation tends to create a positive feedback loop where faith in the currency is lost so people spend as much as they can as fast as they can, driving prices up even higher.

Econo-geddon![edit]

So what's all this talk about hyperinflation and economic Armageddon? I mean, Glenn Beck keeps telling me we'll be burning money for warmth soon.[20]

Well, he warned about it in 2008, and then 2009, and then 2010. Oops, CPI actually went through a deflationary period in 2009 and was at just over 1% at the end of 2010. Core inflation has been steadily falling since 2008. Well, Beck has to sell his gold, gold, gold! And so do a lot of scam artists who like to stoke hyperinflation fears.[21] Makes you wonder if gold is the way to go, why do they want to sell it to you instead of hanging onto it?

The fact of the matter is that the US is a global economic superpower with a gigantic intertwining globalized economy. Contrary to Glenn Beck's assumption that dollars are being thrown away, many nations are flocking to it, as they have faith in the central banking system of the US to not renege on the promise to return an equal value of product per unit currency, and on the dollar to be a good relative store of value. There are even entire black markets in states like Venezuela and North Korea, where the government forces their own currencies to be much too overvalued, and its own population find the store of the dollar to be so much more appropriate that they risk death to hold dollars instead.

In a bitter sense of irony, the dollar is far more likely to be forced to hyperinflate by a crash resulting from the perpetually extensive war-spending and anti-science attitudes of these conservatives, than of a few billion dollars of quantitative easing (however silly) into the M3 money supply, in an economy with a value of trillions.

The US is not the Weimar Republic[edit]

"Printing money" has become synonymous with the Weimar Republic, but all nations with sovereign currencies have to print money at some point, otherwise the money supply could never expand (obviously). So what's different about the Weimar Republic?

- Massive war reparations that some economists warned were much more than Germany could hope to pay back, piling a massive debt on top of a country already torn apart by World War I.

- The country was stripped of its colonies and France swiped some of its manufacturing centers (the Rhineland and Ruhr) and natural resources.

- 1923 was a difficult year for the Republic: There was an attempted coup

from the far right and an attempted uprising from the communists - that does not tend to engender trust in the economic strength of a country

from the far right and an attempted uprising from the communists - that does not tend to engender trust in the economic strength of a country - The German government had saddled itself with huge obligations in addition to reparation debts and normal debts, they also paid for everybody who partook in the strike in the Rhineland

- Monetizing debt all at once to make payments on time.

- Dr. Rudolf Havenstein, President of the Reichsbank, refused to believe that there was any connection between the money supply and the rate of inflation.[22]

- Members of some social groups, like farmers and unionized workers, initially suffered far less from inflation than others, especially pensioners.

- Political instability: the democratic center of liberals and social-democrats lost popular support to the authoritarians of the right and extreme left.

- The hyperinflation came to an end when Germany moved to the Rentenmark, which was backed by land.[23]

- Germany had had ever increasing inflation since World War I began, first to finance the war and later to pay reparations. 1923 just made it all that much worse.

All in all, the 1923 inflation was a perfect storm and even then just not printing money at breakneck speed could have kept it from happening.

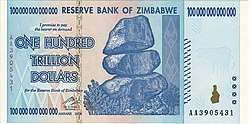

The US is not Zimbabwe either[edit]

In the early 2000s, Zimbabwe enacted land reforms that ended up destroying its agricultural base, which made up most of their economy. So they had no food and printed tons of money to import some. Recipe for disaster. There's a common thread here: hyperinflation tends to happen in nations that have a very weak and non-diverse economy or problems with political stability. Don't start stuffing gold under your mattress just yet. And even if the dollar does go kaput, in that case, you're going to have way more things to worry about than how many gold bars you've got.

The US has had periods of hyperinflation in the past[edit]

During the American Revolutionary War when the Continental Congress authorized the printing of paper currency called continental currency, the monthly inflation rate reached a peak of 47 percent in November 1779[24]. These notes depreciated rapidly, giving rise to the expression "not worth a continental." In fact, one major cause was the British counterfeiting continual currency as fast as the press on board the HMS Phoenix, moored in New York Harbor, could crank them out and sold nearly at the same value as the very paper they were printed on.[25]

During the U.S. Civil War both the Confederacy and Union printed money like crazy with Confederacy currency becoming worthless near the end of the war and Union currency being slightly inflated.

Two greatest depressions in US history were NOT caused by hyperinflation[edit]

The Long Depression![]() and Great Depression

and Great Depression![]() were not the products of hyperinflation but rather deflation (i.e. too many goods for a certain number of dollars) and an economic bubble bursting. In fact, economists from the far left to pretty far right all agree that a certain amount of inflation is healthy and necessary for a modern economy and deflation is the worst thing that can happen to an economy. What the disagreement is about, however is whether "healthy" inflation is below 2%, somewhere around 5% or at some other level. The European Union for instance has made "inflation below 2%" a rule its Central Bank works by.

were not the products of hyperinflation but rather deflation (i.e. too many goods for a certain number of dollars) and an economic bubble bursting. In fact, economists from the far left to pretty far right all agree that a certain amount of inflation is healthy and necessary for a modern economy and deflation is the worst thing that can happen to an economy. What the disagreement is about, however is whether "healthy" inflation is below 2%, somewhere around 5% or at some other level. The European Union for instance has made "inflation below 2%" a rule its Central Bank works by.

See also[edit]

References[edit]

- ↑ "Commanding Heights : Keynes on Inflation | on PBS". www.pbs.org. Retrieved 2024-04-09.

- ↑ "Inflation: True and False". Hoover Institution. Retrieved 2024-03-30.

- ↑ [1]

- ↑ "Biden could reduce inflation, mitigate a recession, and strengthen democracy with a new EU-US trade agreement". Brookings. Retrieved 2024-03-30.

- ↑ Summers, Lawrence (April 6, 2022). "Trade barrier reduction is the most important anti-inflation competition policy".

- ↑ "Does Political Instability Lead to Higher Inflation? A Panel Data Analysis". IMF. Retrieved 2024-03-30.

- ↑ Thomsen, Ian (2022-08-02). "What is greedflation – and is it driving higher prices?". Northeastern Global News. Retrieved 2023-06-01.

- ↑ Giles, Chris (2023-05-30). "UK corporate profitability stable despite 'greedflation' claims". Financial Times. Retrieved 2023-06-01.

- ↑ "'Greedflation' explored: Are businesses making inflation worse through excessive profits?". Sky News. Retrieved 2023-06-01.

- ↑ "How Much Have Record Corporate Profits Contributed to Recent Inflation?". www.kansascityfed.org. 2023-01-12. Retrieved 2023-06-01.

- ↑ Conlon, Christopher; Miller, Nathan H.; Otgon, Tsolmon; Yao, Yi (2023-05). "Rising Markups, Rising Prices?". AEA Papers and Proceedings. 113: 279–83. doi:10.1257/pandp.20231098. ISSN 2574-0768.

{{cite journal}}: Check date values in:|date=(help) - ↑ 12.0 12.1 https://www.npr.org/2023/05/19/1177180972/economists-are-reconsidering-how-much-corporate-profits-drive-inflation

- ↑ Corporate profits have contributed disproportionately to inflation, here's how policymakers should respond - Economic Policy Institute

- ↑ "Euro Area Inflation after the Pandemic and Energy Shock: Import Prices, Profits and Wages". IMF. Retrieved 2023-09-25.

- ↑ 15.0 15.1 15.2 Perkins, Tom (January 19, 2024). "Half of recent US inflation due to high corporate profits, report finds". The Guardian.

{{cite web}}: Italic or bold markup not allowed in:|publisher=(help) - ↑ Bourne, Ryan (2024-01-25). "New Nonsense on Profit-Driven Inflation". The War on Prices. Retrieved 2024-01-29.

- ↑ "What caused the U.S. pandemic-era inflation?". Brookings. Retrieved 2024-01-29.

- ↑ 18.0 18.1 Japan’s ‘dirt sandwich’ of negative rates difficult to swallow: analyst Jul 14, 2016 Japan Times.

- ↑ In accounting, the threshold is usually doubling price over 3 years, which is much less than what the economists use.

- ↑ Beck Continually Warns of Inflation

- ↑ Dismantling Hyperinflation

- ↑ Adam Ferguson. 1975, 2010 reprint. When Money Dies. New York: Public Affairs. pp. 170-172.

- ↑ As We Go Marching, John Flynn, 1944, p. 92.

- ↑ Peter Bernholz (2003) Monetary Regimes and Inflation: History, Economic and Political Relationships pg 48

- ↑ Stealing Lincoln’s Body (Cambridge, Mass.: Belknap Press of Harvard University Press, 2007: pg. 33