Great Depression

| The dismal science Economics |

| Economic systems |

| Major concepts |

| The worldly philosophers |

The Great Depression of 1929 to the late 1930s was the largest economic downturn in the history of the modern world. Although market's boom and bust cycle has been producing a bust roughly every few decades or so since the early 19th century, this was by far the worst.

The Roaring Twenties come to a close[edit]

The atmosphere of the late 1920s (financially speaking, at least) can be summed up in the following (likely apocryphal) anecdote: in the winter of 1928, Joe Kennedy decided to stop to have his shoes shined before he started his day's work at the office. When the boy finished, he offered Kennedy a stock tip: "Buy Hindenburg." Kennedy soon sold off his stocks, thinking:

“”You know it's time to sell when shoeshine boys give you stock tips. This bull market is over.

|

A timely move considering that the stock market would soon resemble the fate of the airship Hindenburg itself.

Causes[edit]

Like most historical events, the Great Depression was caused by several factors, including market failures, government failures and environmental factors.

Keynes versus Friedman[edit]

The Keynesian explanation, based on John Maynard Keynes' book The General Theory of Employment, Interest and Money, attributes the crises to the lack of investments coupled with serious errors in fiscal policy. According to the Keynesian explanation, the chain of bankruptcies of companies and banks in 1931 spread pessimism and disorganized the financial system to the point where the recession became the Great Depression. The stock market collapse added to the pessimism and further inhibited aggregate demand via capital losses. Furthermore, with stock prices heavily depressed, it was cheaper to buy an existing industry than to build a new one, an additional reason not to invest. The continuous fall in prices further aggravated the scenario, imposing strong real losses on companies who had become indebted in the past.

This explanation does not attach greater importance to the monetary contraction between 1931 and 1933 for one reason: nominal interest rates had already fallen to zero. The underlying hypothesis here is that that the effects of monetary policy on output and employment only operate via the nominal interest rate. In fact, there are two other variables not considered in the Keynesian diagnosis: the real liquidity effect and the impact on the expectation of price changes.

This was the point used by Milton Friedman to provide an entirely different diagnosis of the Great Depression in his book A Monetary History of the United States, which he co-wrote with his Chicago colleague Anna Schwartz![]() . According to Friedman and Schwartz, the depression was the result of the Federal Reserve's mistakes, which allowed the monetary base to fall. These were not errors by action, but by omission. Due to the many bank failures in the period, the public withdrew their deposits from banks and started to keep their money home, causing a huge drop in the money multiplier

. According to Friedman and Schwartz, the depression was the result of the Federal Reserve's mistakes, which allowed the monetary base to fall. These were not errors by action, but by omission. Due to the many bank failures in the period, the public withdrew their deposits from banks and started to keep their money home, causing a huge drop in the money multiplier![]() . Instead of neutralizing this fall through monetary expansion, the FED idly stood by, allowing the means of payment to fall sharply, triggering deflation and depression. Yeah, you can say that even Milton Friedman would support money printing once in a while.

. Instead of neutralizing this fall through monetary expansion, the FED idly stood by, allowing the means of payment to fall sharply, triggering deflation and depression. Yeah, you can say that even Milton Friedman would support money printing once in a while.

While scholars still argue on who was more correct, Keynes or Friedman, some common ground can be found and most economists agree on at least some reasons, which we'll see now.

Bank runs (Diamond–Dybvig model)[edit]

After a speculative bubble burst in 1929 (the infamous Great Crash![]() ),[1] the American economy entered a recession, like many others in American history, but still not a depression. Things got a lot worse when a series of bankruptcies began, especially when the Bank of United States

),[1] the American economy entered a recession, like many others in American history, but still not a depression. Things got a lot worse when a series of bankruptcies began, especially when the Bank of United States![]() declared bankruptcy in 1930.[2] The bank was the largest commercial bank as measured by volume of deposits ever to have failed up to that time in American history, and its bankruptcy had a huge effect on confidence in the U.S. banking system.[3] This all happened after the Crash.

declared bankruptcy in 1930.[2] The bank was the largest commercial bank as measured by volume of deposits ever to have failed up to that time in American history, and its bankruptcy had a huge effect on confidence in the U.S. banking system.[3] This all happened after the Crash.

But how did these bankruptcies resulted in the Depression? The Diamond–Dybvig model![]() shows us that one of the Nash equilibria of a fractional reserve system is the bank run. In short, banks keep a fraction of their deposits in cash and lend the rest, but since not everyone withdraws at the same time, the system keeps working normally in usual situations. But if people start to question the ability of banks to honor deposits, then we have a problem. That's what happened during the Great Depression: a herd behavior of people going to the banks to get their money.[4]

shows us that one of the Nash equilibria of a fractional reserve system is the bank run. In short, banks keep a fraction of their deposits in cash and lend the rest, but since not everyone withdraws at the same time, the system keeps working normally in usual situations. But if people start to question the ability of banks to honor deposits, then we have a problem. That's what happened during the Great Depression: a herd behavior of people going to the banks to get their money.[4]

Basically, it works like this: if a depositor thinks that other depositors will withdraw their money, it's rational for them to run to withdraw too before the bank runs out of money, even if they don't need the money at that moment. When everyone rationally acts like this, there is a bank run![]() , where the rational, self-interested action of all players leads to a bad outcome for all of them.

, where the rational, self-interested action of all players leads to a bad outcome for all of them.

It was arguably possible to prevent the Great Depression by guaranteeing private deposits in the banks. The FED needed to bail out the Bank of United States with a line of credit and publicly announce that it would do the same for any other major bank that needed liquidity. Does that mean that some banks are too big to fail? Not necessarily. The most important point is to save the account holders, not the banks.

In 2022, Douglas Diamond and Philip H. Dybvig won the Nobel Memorial Prize along with Ben Bernanke for "research on banks and financial crises".[5]

Price declines and debt deflation (Fisher equation)[edit]

One explanation from the time of the Depression that still holds was presented by economist Irving Fisher in 1933.[6][note 2]

With the bank run, people began to exchange dollars for gold to protect themselves. This caused a sharp contraction of the monetary base, which had an impact on prices. The wholesale price index declined 33 percent between 1929 and 1933 was 33%, while the monetary base shrinked by a 31%.[8] As real interest corresponds to interest minus inflation (the Fisher equation![]() ), deflation raises the real interest rate, and this is what happened during the Great Depression.

), deflation raises the real interest rate, and this is what happened during the Great Depression.

This huge price deflation, unanticipated and not provided in contracts by indexation clauses, made the interbank and customer debts heavier in real terms, which aggravated the breakdown of the system. There was a vicious cycle: the bank run caused the monetary base to shrink, which caused deflation. This exacerbated the crises in the financial system, pushing more banks into bankruptcy. Bankruptcies undermined confidenced and increase the bank run itself. The cycle repeats. Over and over.

That's not the only bad thing about deflation. People often stop spending their money in deflationary scenarios. Why would you spend your money today if things will be cheaper tomorrow? Giving an example, let's suppose you want to buy a new computer and spend US$1000 on it. However, you expect that next month the same computer will cost only 900 dollars. Unless you really need a new computer, the rational thing to do to wait. As a result, a huge deflation, such as the one that happened during the Great Depression, may halt the entire economy.

Rigidity of nominal wages (expectations, contracts, coordination problem)[edit]

This rapid drop in prices and the collapse in the money supply would require a similarly large drop in nominal wages to preserve employment, which is totally unfeasible in the short term.

Put simply, the nominal wage is readjusted by inflation expectations plus a component related to the output gap, and that inflation expectations vary according to the deviation of current inflation from expectations. This means that a change in inflation changes the derivative of the inflation expectation, causing the inflation expectation to change with a delay; and in the meantime, when expectations are adapting, money wages grow at a different rate than prices. In addition, wages are generally fixed in a contract, with an agreed term in a time interval, and even assuming that agents behave according to rational expectations, there are also coordination problems at the microeconomic level that create this rigidity in nominal wages.[9] To make matters worse, the government still tried to designed some ill-advised policies to prop up wages, include Hoover’s jawboning with manufacturers to get them to maintain higher nominal wages and the Roosevelt administration’s pressure to keep wages high while industry established its Codes of Competition on the National Industrial Recovery Act.[10]:272

As, for the above reasons, wages were incapable of reacting so quickly to deflation, and the abrupt fall in prices ended up increasing the level of real wages (salary/cost of living). It's true, wages could now buy more stuff, but at what price? Most companies couldn't pay those wages. They had to fire people and/or slow their activities. It is important to mention that this only became a problem after 1931, before that, wages weren't so sticky.[10]:13

It's true, lowering wages might seem as a cruel thing to do, especially during a depression, but the alternative (destroying more and more jobs) also means that most people would receive less, not more money.

The gold standard[edit]

According to Ben Bernanke, there’s also evidence that the gold standard was responsible for the worldwide deflation of the late 1920s and early 1930.[11]

As the gold standard is largely deflationary, countries that left it, like the UK, were able to reflate their money supplies and price levels, and did so after some delay; countries remaining on it, like France, sunk into further deflation.[12]

On his lecture while receiving the Nobel Memorial Prize in Economics in 1999, economist Robert Mundell said "Had the price of gold been raised in the late 1920’s, or, alternatively, had the major central banks pursued policies of price stability instead of adhering to the gold standard, there would have been no Great Depression, no Nazi revolution and no World War II."[13]

France[edit]

The FED and US aren't the only entities that should be blamed for the Depression. Indeed, there's evidence that France's gold buggery was one of the causes of the downturn. Between 1927 and 1932 France increased its share of world gold reserves from 7 percent to 27 percent. By hoarding gold, France created an artificial shortage of reserves and put other countries under enormous deflationary pressure. Counterfactual simulations indicate that world prices would have increased slightly between 1929 and 1933, instead of declining calamitously, if the historical relationship between world gold reserves and world prices had continued.[14]

Dust Bowl[edit]

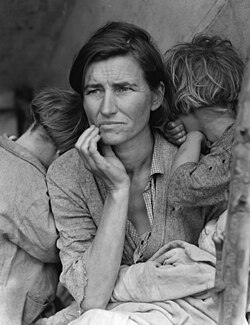

The Dust Bowl![]() was a sandstorm weather phenomenon that occurred in the United States in the 1930s and lasted nearly ten years. They devastated the American Great Plains, crushing the agriculture and intensifiying the Great Depression in the period.

[15] Despite having a relatively low impact on the American macroeconomy as a whole, the Dust Bowl still heavily affected and impoverished the life of those living in the Great Plains during the period, forcing, for instance, millions to migrate.

was a sandstorm weather phenomenon that occurred in the United States in the 1930s and lasted nearly ten years. They devastated the American Great Plains, crushing the agriculture and intensifiying the Great Depression in the period.

[15] Despite having a relatively low impact on the American macroeconomy as a whole, the Dust Bowl still heavily affected and impoverished the life of those living in the Great Plains during the period, forcing, for instance, millions to migrate.

Hopefully, however, even during the period, deaths by starvation dropped in US.[16]

Not causes[edit]

Just like there is a relatively strong consensus among economists on some of the causes, most economists agree that some explanations are just not good enough.

The Crash[edit]

Just like we saw, the crash might have resulted in a recession. The data however suggests that the depression only happened after the FED failed to do its job, and by the fall of 1930 economic recovery appeared imminent.[17]

The Smoot-Hawley Tariff and government intervention[edit]

In an attempt to protect US industry against foreign competition, the American Congress passed strong protectionist measures. The other countries responded in kind, and the result was the collapse of international trade. There is little doubt that The Smoot-Hawley Tariff was a bad idea, as imports dropped by 40% during the period, but the total impact of the tariff on the GDP drop (around 30%) is less than 0.5%.[18]

Economist Thomas Sowell argues that the depression was caused by new regulations and government interventions settled by Hoover and Roosevelt.[19] Again, a considerable part of these regulations were bad. Even Keynes recognized that so much regulation would create terrible incentives.[20] However, most of this happened after the depression has started or even when the economy was showing signs of recovery. The NRA, for instance, was created in 1933 and was dissolved only two years after.[21] At most, these novel policies prevented a faster recovery (as we saw, the ones that made wages sticky were specifically disastrous), but they didn't really cause the Great Depression, which was happened before they were implemented. On the other hand, some of these policies might have helped the economy to recover, such as bank holidays and the creation of the Federal Deposit Insurance Corporation![]() .

.

European recovery from World War One[edit]

Having your commercial partners growing is a good thing for you, and all the countries profit from trade.[22] If anything, such recovery should result in more economic growth in US, not in a depression. Indeed, falling incomes alone resulted in a considerable double-digit drop of the world trade.[23]

The Austrian School explanation[edit]

The Austrian Business Cycle Theory (ABCT) ironically relies on a market failure that most non Austrian economists disagree with. According to the Austrian economists, as the interest rates drop, people will invest more as they believe that the economy is in good shape, except that it isn't. Simply put, they believe that businessmen are stupid, and have no rational expectations. Market agents know that a lower interest rate now means a higher interest rate in the future, and make their movements based not only based on what they know from the past, but also considering the future.[24]

The New Deal[edit]

The economy continued to nosedive heading toward the 1932 election. Everything bottomed out around 1932-1933, but many expected things to (somehow) keep getting worse. The banking system had not completely stabilized. Not only had Hoover become wildly unpopular because of the Depression, the tide began to turn against him on Prohibition as well. Not to mention the Bonus Army of veterans that marched on Washington, who he turned away. Hoover's platform basically consisted of "It's gonna get better, promise!" Franklin Roosevelt ran as a fiscal conservative in some places and touted a "New Deal" in others. He wasn't very specific about what would be in it, though, he mostly talked about "reform."

Although FDR, then governor of New York, was still seen as a political lightweight at the time, he easily trounced Hoover and the Democrats took the majority in Congress. The election of 1932 was a significant political realignment. The Republican Party was in shambles; not only had Hoover ruined their reputation, the rift between the conservative wing ("Taft Republicans") and the progressive wing (think Teddy Roosevelt) was blown wide open. Hoover's racial gaffes allowed FDR to pick up the black vote. He also picked up the youth vote, the immigrant vote, the labor vote (labor had actually gone mostly Republican up until this point) and the old white guy vote.[25] This was known as the "New Deal Coalition."

Some stuff that happened in FDR's first term:

- FDR bombarded Congress with a flurry of New Deal legislation in his first 100 days. Despite FDR being remembered as ultra-liberal today, the New Deal lacked a real driving ideology behind it besides "throw stuff at the wall and see what sticks." Most of the programs were expansions of Hoover's policies, adaptations of relief programs Governor Al Smith had implemented in New York before FDR took over, and a mix of ideas from the Brains Trust.

- Bank holidays and the end of the gold standard brought stability to the banking system.

- Economic recovery began.

- The Pecora Commission investigated financial fraud.

- Droughts and erosion brought on the Dust Bowl. Farmers, many of whom were already deep in debt, got screwed even harder.

- Rising Democratic Party star Huey Long was assassinated.

- The Business Plot was uncovered. Retired General Smedley Butler accused a number of businessmen of planning a coup against FDR and installing him as a puppet president. Only a few low-level lackeys confessed and the depth and seriousness of this plot is still in contention.

- Repeal of Prohibition.

- Good Neighbor Policy toward Latin America.

- The strengthening of New Deal Coalition.

FDR's second term[edit]

Alf Landon ran against FDR in 1936 on a platform of "I can do the New Deal, but better." He lost in a landslide, despite the increasing radicalization of wingnuts like Father Coughlin and the conservative wing of the Republican Party. FDR was demonized as a communist, fascist, etc. FDR's response? "I welcome their hatred!"[26]

FDR's court-packing plan was also an unpopular move. Technically constitutional but still a fairly naked power grab.

Roosevelt Recession (1937-38)[edit]

When most of Europe was coming out of the Depression, the US sank into a recession within the Depression. Lasting from May 1937 until June 1938, the Roosevelt Recession is less known, but not less controversial. Causes of this one are still unclear, with some of the explanations including a sharp fiscal and monetary contraction that was needed to fight the signs of a rising inflation, although, unlike the 1929-33 recession in this case, wages don't seem to be a major cause.[27]

While relatively quick, the recession was huge. As economist Patricia Waiwood from the Federal Reserve Bank of Cleveland says:[28]

According to the National Bureau of Economic Research, the 1937 contraction, which lasted from May 1937 until June 1938, was America’s third-worst recession of the twentieth century, paling in comparison to the 1920 and 1929 downturns. A few statistics reveal the severity of the 1937 recession: Real GDP fell 10 percent. Unemployment, which had declined considerably after 1933, hit 20 percent. Finally, industrial production fell 32 percent (Bordo and Haubrich 2012).

End of the Depression[edit]

Put simply, the recovery started when deflation turned into inflation and, as the prices went up, the real interest rates went down. This all made investments cheaper, putting people back to work. And what caused this?

According to economist Christina Romer:[29]

Monetary developments were a crucial source of the recovery of the U.S. economy from the Great Depression. Fiscal policy, in contrast, contributed almost nothing to the recovery before 1942. The very rapid growth of the money supply beginning in 1933 appears to have lowered real interest rates and stimulated investment spending just as a conventional model of the transmission mechanism ould predict.

But what caused the growth in the money supply? One of the reasons according to her, was a huge inflow of gold to the country. And what caused this inflow? A possibility was the rise of totalitarian states in Europe during the period. Put simply, people wanted a safer country to invest their money – and countries like Nazi Germany and Fascist Italy didn't offer this. This view also challenges the common view that the World War II was one of the reasons of the recovery since, according to Romer, the economic activity was already back to its trend level before the fiscal stimulus started in earnest in 1942.

Getting rid of the gold standard was also a good idea, as well as creating deposit insurances, since people didn't need to run to their banks in order to save their money anymore.

Popular culture[edit]

Economic hardship during the Depression displaced a lot of people. A large number of teenagers were forced to leave home to look for work because their parents could no longer support them, and dustbowl conditions led to a mass migration from the midwest, especially Oklahoma and Arkansas, to California. A popular culture grew up around such displaced people with the most popular including Woody Guthrie's folk music, John Steinbecks 1939 novel The Grapes of Wrath and the 1940 film adaptation, the songs "Big Rock Candy Mountain" (Harry McClintock) and "Brother Can You Spare A Dime" (E. Y. "Yip" Harburg and Jay Gorney), and King Vidor's 1934 film Our Daily Bread. Novels and films from that era tended to run in two opposing directions: the realism school of fiction portrayed the hardships of the working class while sometimes also romanticising them, while others went in the other direction of escapism and portrayed the lifestyles of the wealthy. The period was rife with moral panic with a lot of drug scare movies like Reefer Madness, but conversely was also an era in which open inquiry and freethought flourished, typified by the popularity of Haldeman-Julius Publishing's Little Blue Books. The American Girl doll character of Kit Kittredge has her backstory set during the onset of the Great Depression, albeit in a more romanticised manner appropriate for children; it did however have its moments especially in the film adaptation starring Abigail Breslin![]() where families are shown being evicted and now-destitute people subsisting in soup kitchens. The film adaptation was also released in 2008 at the height of the Great Recession, and during the film's production, one of the cast members told producer Elaine Goldsmith-Thomas that her friend also lost their home in a similar foreclosure.

where families are shown being evicted and now-destitute people subsisting in soup kitchens. The film adaptation was also released in 2008 at the height of the Great Recession, and during the film's production, one of the cast members told producer Elaine Goldsmith-Thomas that her friend also lost their home in a similar foreclosure.

This influence on popular culture has continued to echo in influence in the U.S. The folk music scene typified by Woody Guthrie and the romanticisation of migratory people in general were both influential on the late 1960s hippie movement, while occasional popular films continue to play to the realism school of Depression-era fiction, examples being 1967's Bonnie and Clyde, 1973's Emperor of the North, and the more recent Seabiscuit and O Brother, Where Art Thou? The Civilian Conservation Corps, a Depression-era jobs program for young men, likewise continues to be cited as a model for programs today like Americorps, and is often romanticized as a golden age of construction due to the CCC's having built many buidings and trails in today's national and state parks. The Dust Bowl Ballads![]() album, by Woody Guthrie, is considered one of the first concept albums in history.

album, by Woody Guthrie, is considered one of the first concept albums in history.

Notes[edit]

- ↑ More embellished version here

- ↑ Ironically, despite giving a good diagnosis of the Depression, Fisher ruined much of his reputation by failing at predicting the crisis. Only nine days before that crash, he famously said that stock prices have reached "what looks like a permanently high plateau".[7]

References[edit]

- ↑ De Long, J. Bradford; Shleifer, Andrei (1991). "The Stock Market Bubble of 1929: Evidence from Closed-end Mutual Funds". The Journal of Economic History. 51 (3): 675–700. ISSN 0022-0507.

- ↑ Gray, Christopher (August 18, 1991). "Streetscapes: The Bank of the United States in the Bronx; The First Domino In the Depression". The New York Times.

- ↑ Friedman, Milton (2008). The great contraction, 1929-1933. Anna J. Schwartz, National Bureau of Economic Research. Princeton: Princeton University Press. p. 28. ISBN 978-1-4008-4685-6. OCLC 844923080.

- ↑ Diamond, Douglas W.; Dybvig, Philip H. (1983). "Bank Runs, Deposit Insurance, and Liquidity". Journal of Political Economy. 91 (3): 401–419. ISSN 0022-3808.

- ↑ "All Nobel Prizes 2022". NobelPrize.org.

{{cite web}}: Unknown parameter|access date=ignored (|access-date=suggested) (help) - ↑ Fisher, Irving (1933). "The Debt-Deflation Theory of Great Depressions". Econometrica. 1 (4): 337–357. doi:10.2307/1907327. ISSN 0012-9682.

- ↑ "FISHER SEES STOCKS PERMANENTLY HIGH; Yale Economist Tells Purchasing Agents Increased Earnings Justify Rise.SAYS TRUSTS AID SALESFinds Special Knowledge, Applied to Diversify Holdings, ShiftsRisks for Clients". The New York Times. 1929-10-16. ISSN 0362-4331. Retrieved 2022-11-24.

- ↑ "Great Depression | Definition, History, Dates, Causes, Effects, & Facts | Britannica". www.britannica.com. Retrieved 2022-11-07.

- ↑ Simonsen, Mario Henrique. "Rational Expectations, Game Theory and Inflationary Inertia". The Economy as an Evolving Complex System. CRC Press. pp. 205–241. ISBN 978-0-429-49284-6. Retrieved 2022-11-17.

- ↑ 10.0 10.1 The Great Depression of the 1930s : lessons for today. N. F. R. Crafts, Peter Fearon. Oxford: Oxford University Press. 2013. ISBN 978-0-19-164009-4. OCLC 829994095.

{{cite book}}: CS1 maint: others (link) - ↑ Bernanke, Ben; James, Harold (1990-10). "The Gold Standard, Deflation, and Financial Crisis in the Great Depression: An International Comparison".

{{cite journal}}: Check date values in:|date=(help); Cite journal requires|journal=(help) - ↑ Bernanke, Ben S. (1994-08). "The Macroeconomics of the Great Depression: A Comparative Approach".

{{cite journal}}: Check date values in:|date=(help); Cite journal requires|journal=(help) - ↑ "The Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel 1999". NobelPrize.org. Retrieved 2022-11-24.

- ↑ Irwin, Douglas A. (2010-09). "Did France Cause the Great Depression?".

{{cite journal}}: Check date values in:|date=(help); Cite journal requires|journal=(help) - ↑ See the Wikipedia article on Dust Bowl.

- ↑ Tapia Granados, José A.; Diez Roux, Ana V. (2009-10-13). "Life and death during the Great Depression". Proceedings of the National Academy of Sciences. 106 (41): 17290–17295. doi:10.1073/pnas.0904491106. ISSN 0027-8424. PMC 2765209. PMID 19805076.

{{cite journal}}: CS1 maint: PMC format (link) - ↑ "Stock Market Crash of 1929 | Federal Reserve History". www.federalreservehistory.org. Retrieved 2022-11-08.

- ↑ Irwin, Douglas A. (1998). "The Smoot-Hawley Tariff: A Quantitative Assessment". The Review of Economics and Statistics. 80 (2): 326–334. ISSN 0034-6535.

- ↑ "Thomas Sowell: The myth of how the Great Depression was resolved". Washington Examiner. 2010-06-18. Retrieved 2022-11-07.

- ↑ Keynes, John Maynard (1963). Essays in persuasion. New York: Norton. pp. 272–73. ISBN 0-393-00190-3. OCLC 316807560.

- ↑ See the Wikipedia article on National Recovery Administration.

- ↑ Krugman, Paul R. (1993). "The Narrow and Broad Arguments for Free Trade". The American Economic Review. 83 (2): 362–366. ISSN 0002-8282.

- ↑ Madsen, Jakob B. (2001). "Trade Barriers and the Collapse of World Trade during the Great Depression". Southern Economic Journal. 67 (4): 848–868. doi:10.2307/1061574. ISSN 0038-4038.

- ↑ Lucas, Robert E (1972-04-01). "Expectations and the neutrality of money". Journal of Economic Theory. 4 (2): 103–124. doi:10.1016/0022-0531(72)90142-1. ISSN 0022-0531.

- ↑ 1932 Presidential General Election data by state (Dixiecrats.)

- ↑ FDR's Madison Garden Speech

- ↑ Velde, Francois R. (2009-11-01). "The Recession of 1937: A Cautionary Tale". Rochester, NY.

{{cite journal}}: Cite journal requires|journal=(help) - ↑ "Recession of 1937–38 | Federal Reserve History". www.federalreservehistory.org. Retrieved 2022-11-08.

- ↑ Romer, Christina D. (1991-09). "What Ended the Great Depression?".

{{cite journal}}: Check date values in:|date=(help); Cite journal requires|journal=(help)