Enron

| I, the crown prince of Nigeria, offer you Scams |

| Hook, line, and sinker |

| Totally sounds legit! |

“”In the Titanic, the captain went down with the ship. In Enron, it looks to me like the captain first gave himself and his friends a bonus, then lowered himself and the top folks down the lifeboat and then hollered up and said, 'By the way, everything is going to be just fine.'

|

| —Senator Byron Dorgan[1] |

Enron Corporation was an energy and commodities trading company that is now synonymous with the words "fraud," "rip-off," "corruption," "epic fail," and "holy shit these guys are crooked!" It may also be used as a verb, as in: "We cooked the books, took our bonuses, and got the hell out of Dodge — you know, Enronned 'em."

Valhalla: The corruption starts early[edit]

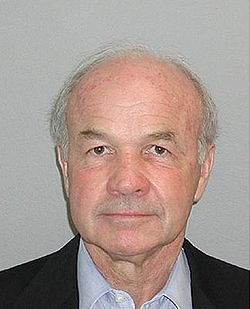

In the 1980s, an Omaha-based natural gas company called InterNorth merged with Houston Natural Gas to become HNG/InterNorth (sometimes written as HNG-InterNorth).[2] The CEO of the company, Sam Segnar, left in 1985, allowing Ken Lay to ascend to power; HNG and InterNorth execs both claimed Segnar voluntarily retired, but in reality, the latter group had pressured him into resigning.[3]:12

As CEO, Lay swiftly filled the board of directors with cronies. Initially, the firm's corporate headquarters was based in Omaha while its operations headquarters was located in Houston as a compromise between the two factions, but Lay eventually relocated the former to Houston as well, where he rebranded the company as "Enteron." When someone notified him that he had inadvertently named his company after a medical term for "intestinal tract," Lay renamed the company to "Enron."[3]:13-14 "Enrot" or especially "Enrob" would have either been far more appropriate, in view of the subsequent history of the firm.

A confluence of three events laid the groundwork for the mind-boggling web of financial bullshit that Lay and his cronies would weave. Almost immediately, Enron began to tank under Lay, causing him to start selling off a good number of the company's vast network of gas plants and pipelines. While he pawned off his company's assets, the Reagan administration happened to be holding the hearings commissioned by the Task Force on Regulatory Relief, headed by Phil Gramm's wife Wendy. Lay, a Ph.D. in economics, preached the Gospel of Deregulation at the hearings, which ultimately resulted in the government lifting regulations on the energy market. By 1987, the market had begun to work its magic, at least for Enron's Valhalla, New York-based branch. While most Enron subsidiaries were just scraping by or losing money, Valhalla was rolling in the dough.

Two of the top traders, Louis Borget and Tom Mastroeni, were making their money by trading large amounts of gas futures, or gambling in common parlance. They skimmed money off the top of the profits by laundering it through foreign accounts. However, Enron's auditors detected fraud in their actions, and Borget and Mastroeni were summoned to Houston. In Houston, Lay decided to let them continue their trading, as he needed their profits to keep the company afloat. One of the auditors went so far as to track down the traders and make a death threat against them that ultimately resulted in them fessing up by releasing some documents they had sat on. An SEC suit followed and Mastroeni got the boot with a steep fine and Borget ended up in the slammer. Lay denied knowledge of the incident.

The next generation of swindlers[edit]

Lay managed to secure subsidies from the new president George H.W. Bush, whom he had buddied up with during the days of the Task Force on Regulatory Relief while Papa Bush was still VP. However, Enron had taken a severe hit in the wake of losing Borget and Mastroeni, the market crash of 1987, and the ensuing Savings and Loan Crisis. Lay needed "ideas men," so he brought two young guns on board in the early '90s: Jeff Skilling and Andy Fastow.

Skilling's favorite book was The Selfish Gene by Richard Dawkins.[4] He never got the memo that evolution does not equal Social Darwinism. For his part, Dawkins later wrote in The God Delusion that he was horrified to learn that such a powerful figure had so horribly misinterpreted his work.[5]:215 Skilling restructured Enron in the mold of "survival of the fittest," making massive lay-offs of low-performing employees and introducing mark-to-market accounting, which allowed future profits to be booked immediately after a deal was made. Skilling thought this "rank-and-yank" system would motivate employees.

Enron took off. While it secured contracts for power plants in England and India, its big bucks were rolling in from the energy traders. Skilling had essentially replicated the Valhalla branch and turned Enron's financial branch into a sort of stock market for energy speculation. Naturally, a lot of these mark-to-market deals went down in flames. In 1993, Enron created the Joint Energy Development Investment Limited (JEDI), which was a pension fund that bought Enron assets. Fastow came up with a brilliant "innovation" to take the debt off Enron's books: Special Purpose Entities (SPEs, or dummy corporations in non-bullshit-ese). One of the biggest of these was Chewco (named after Chewbacca), which bought up debt from Enron through JEDI. Fastow spun off a huge number of dummy corporations — LJM, the Raptors, Osprey, Whitewing, etc.[note 1] This network of dummy corporations pawned off Enron's stinky deals on Wall Street investment banks, kept debt off their books, and allowed Enron execs to skim cash off the top. Essentially, all the dummy corps were either dumping grounds for Enron's bullshit or pyramid schemes to keep the investments from Wall Street coming in.

Enron's multi-billion deal in India fell through when the government cancelled the contract, which they had of course booked the profits for years ago. Skilling and Fastow went into overdrive, adding epicycle on epicycle, piling bullshit on bullshit. Skilling decided making new products was for chumps and set up EnronOnline, a virtual stock market for energy and credit derivatives. This market was completely unregulated thanks to Phil Gramm's Commodity Futures Modernization Act of 2000, which contained the "Enron Loophole" allowing energy derivatives to be traded unchecked. Coincidentally, Wendy Gramm had landed a gig at Enron in the late '90s and Enron just happened to be one of Gramm's top campaign contributors. EnronOnline was hailed as a great new "innovation" as it came during the height of the dot com boom. In reality, Enron had completely fucked itself over by this point.

California: The Hail Mary that screwed Grandma Millie[edit]

Enron execs realized they had gotten themselves into such deep shit that they would have to pull off a move of epic proportions. Their company's value had gone up 60% every year since 1996 and its stock was skyrocketing. This facade kept credit flowing into the pyramid scheme dummy corporations as well as getting them glowing reviews in business and finance rags to help boost their stock up even more. In the late '90s, Enron had lobbied California to deregulate its power grid, allowing Enron to buy up a number of power plants. The new scheme? Intentionally create blackouts to drive up energy prices! Tapes of phone conversations between Enron employees and plant workers leaked after Enron collapsed. They made some colorful comments...

“”ENRON EMPLOYEE 2: Now, the magical word of the day is "Burn, baby, burn."

ENRON EMPLOYEE 1: What’s happening? ENRON EMPLOYEE 2: There’s a fire under the core line. It’s been de-rated from 45 to 2,100. ENRON EMPLOYEE 1: Really. Burn, baby, burn! |

| —In reaction to a forest fire burning through power lines |

“”ENRON EMPLOYEE 1: So the rumor is true? They’re f-—ing taking all the money back from you guys? All that money you guys stole from those poor grandmothers in California?

ENRON EMPLOYEE 2: Yeah, Grandma Millie, man. So she’s the one who couldn’t figure out how to f-—ing vote on the butterfly ballot, but yeah, now she wants her f-—ing money back for all the power you’ve charged right up her—jammed right up her a-–for f-—ing $250 a megawatt hour. Yeah, you know. You know Grandma Millie. She’s the one that Al Gore is fighting for. |

“”ENRON EMPLOYEE 1: Tell you what, you heard this here first. When Bush wins, that f-—ing Bill Richardson, he’s gone, that f-—ing Clinton, all these f-—ing socialists are gone.

ENRON EMPLOYEE 2: Yeah. ENRON EMPLOYEE 1: You know who the biggest single contributor to the Bush campaign is? ENRON EMPLOYEE 2: You. ENRON EMPLOYEE 1: Enron.[6] |

After rolling blackouts became a common occurrence, California Governor Gray Davis smelled funny business and asked newly elected president George Bush to launch a federal investigation. Dubya blew him off. Due to Lay's connections with Bush the Elder, he happened to be pals with Dubya as well, who referred to him as "Kenny Boy." Lay happened to be on Dubya's shortlist for Secretary of Energy. Dick Cheney's Energy Task Force also helped block regulations that would have applied to Enron.

The sad thing is that all this chicanery was arguably pointless. Despite Enron's best attempts to spread the gospel of deregulation, very few states had actually opened up their energy grids to the private sector. If the company had actually focused on supplying California with reliable energy instead of trying to game the system, other states might finally see the benefits of deregulation and open up their energy grids to the free market, benefiting Enron. Instead, the company selfishly sacrificed long-term benefits for short-term gains and blamed all the problems they caused on the state government for not making a sufficiently free market.[3]:267

Collapse and aftermath[edit]

When it became apparent that even the California screw-job couldn't save them, Skilling cashed out his stocks and jumped ship. Lay and Fastow tried to keep the pyramid schemes feeding into the massive pump and dump scheme going, while also pawning off their stock and shredding documentation knowing the ship was going down.

During this time, Lay hired Frank Luntz to get a feel for how the employees on the ground were feeling. As you might expect, they were not happy; they saw the company as chaotic and unstable and could tell the higher ups had no idea what they were doing. Luntz recommended that Lay take the helm and make his presence known, proclaiming that Kenny Boy was Enron's "most powerful weapon."[3]:372 Lay went into a paranoiac mania after seemingly drinking too much of his own Kool-Aid, hyping Enron stock to employees and outsiders alike, reassuring investors "the fundamentals were sound," writing op-eds extolling the free market as the savior of mankind, and comparing those asking to see the company's balance sheets to 9/11 hijackers. Lay also started laying himself before the Lord; he started speaking to some of the local pastors over the phone during work hours, and his own son, Mark, who was training to be a minister at a fundie school called Southwestern Baptist Theological Seminary, would periodically send him Bible quotes, including one where a king prays to God for aid during a siege and God sends down an angel to annihilate the attacking army.[3]:385-386

Enron finally collapsed under the weight of its debt, greed, and stupidity in December of 2001, making it the biggest bankruptcy in American history at the time. One Enron exec named Cliff Baxter committed suicide to avoid facing charges; despite leaving a note, the company was so feared that some speculated he was actually murdered as part of a coverup, causing the local police department to investigate his death as a homicide case, complete with DNA testing and graphanalysis.[3]:xvii-xviii Lay was convicted but died before he was sentenced.[7] Fastow was released from prison on December 16, 2011, having served a term of nearly six years, and now works as a document review clerk for a law firm in Houston, Texas.[8] Skilling served 14 years in federal prison before being released in 2019.[9] Arthur Andersen, one of America's prestigious Big Five![]() accounting firms, lost its CPA license and is barely alive, even after a Supreme Court ruling vacated Anderson's felony conviction.[10] Former Enron employees won multi-million dollar lawsuits to get their pensions repaid, but Enron blew billions of dollars in sum, so tons of people still got screwed. Due to Enron as well as a number of other accounting scandals, like Tyco and Worldcom, the Sarbanes-Oxley Bill was passed to limit this sort of fraud. Apparently it didn't do a whole lot.

accounting firms, lost its CPA license and is barely alive, even after a Supreme Court ruling vacated Anderson's felony conviction.[10] Former Enron employees won multi-million dollar lawsuits to get their pensions repaid, but Enron blew billions of dollars in sum, so tons of people still got screwed. Due to Enron as well as a number of other accounting scandals, like Tyco and Worldcom, the Sarbanes-Oxley Bill was passed to limit this sort of fraud. Apparently it didn't do a whole lot.

Awards[edit]

Enron won a number of worthless awards:

- America's Most Innovative Company by Fortune Magazine (6 consecutive years)

- 32nd place in 100 Best Companies to Work For in 2000 by Fortune Magazine, with the authors citing the female representation in management jobs and amount of vacation days. The company placed higher than Whole Foods Market but lower than Microsoft.[11]

- 2002 Ig Nobel Prize in Economics for adapting the mathematical concept of imaginary numbers for use in the business world.[12]

Enron also gave out its own worthless award, the Enron Prize for Distinguished Public Service. The honor roll included:[13]:168

- Nelson Mandela, for bringing Apartheid to a peaceful end and transitioning South Africa to multi-racial democracy.

- Colin Powell, for, umm, being a really great soldier.

- Mikhail Gorbachev, for ending the Cold War.

- Alan Greenspan, for moving interest rates over the lifetime of Enron only once, thus facilitating the explosion of easy credit that ballooned out the economy and generated the dot com bubble and Enron's bumper profits in the first place. Greenspan got his award in November 2001, mere weeks before Enron filed for bankruptcy.

Only two of these men deserved the award.

Conspiracy theories[edit]

After news of Kenneth Lay's death broke out, various randos on the Internet claimed that ol' Kenny Boy was actually still alive and had faked his death to avoid time in prison, with one commenter claiming that Colin Powell, for whatever reason, had faked a illness to personally hand him a new passport and ID.[14] Speaking of Lay, David Icke, being his usual self, claims that that Enron's collapse was part of the Illuminati's plan to crash the world's economy and usher in a one world government.[15] Thankfully, it appears none of these conspiracy theories have gained much traction.

See also[edit]

External links[edit]

- Behind the Enron Scandal: Time Magazine Special Series

- Enron: List of Players

- Gramm and the Enron Loophole e-mails, New York Times

- Enron: The Smartest Guys in the Room, documentary based on the book of the same name.

Notes[edit]

References[edit]

- ↑ Collapse of the Enron Corporation - Hearing Before the United States Senate Committee on Commerce, Science, and Transportation (February 26, 2002)

- ↑ Mary Schlangenstein, InterNorth-HNG merger completed (July 16, 1985) UPI

- ↑ 3.0 3.1 3.2 3.3 3.4 3.5 Bethany McLean and Peter Elkind, The Smartest Guys in the Room (Penguin Books: 2004) ISBN 1591840538

- ↑ Enron: The Smartest Guys in the Room directed by Alex Gibney (2006)

- ↑ The God Delusion by Richard Dawkins (2006) Houghton Mifflin ISBN 9780618680009

- ↑ Enron tape transcripts

- ↑ Disgraced boss Ken Lay dies at luxury ski chalet by Andrew Clark (July 6, 2006) The Guardian

- ↑ Bloomberg Business Week: Enron's Andrew Fastow - The Mistakes I Made March 22, 2012

- ↑ Reuters: Former Enron CEO Jeffrey Skilling Released From Federal Custody February 21, 2019

- ↑ See the Wikipedia article on Arthur Andersen LLP v. United States.

- ↑ Robert Levering and Milton Moskowitz, The 100 Best Companies To Work For: With labor in short supply, these companies are pulling out all the stops for employees (January 10, 2000) FORTUNE Magazine

- ↑ Past Ig Winners, Annals of Improbable Research

- ↑ Niall Ferguson, The Ascent of Money (New York: Allen Lane, 2009)

- ↑ Many doubt Lay is dead by Kristen Hays (July 14, 2006) Aspen Times

- ↑ Alice in Wonderland and the World Trade Center Disaster: Why the official story of 9/11 is a monumental lie by David Icke (2002) Bridge of Love Publications USA ISBN 0953881024