Gold standard (economics)

“”Look, we don’t have the gold standard. It’s not because we don’t know about the gold standard, it’s because we do.

|

| —Allan H. Meltzer destroys Ron Paul with facts and logic.[1] |

| The dismal science Economics |

| Economic systems |

| Major concepts |

| The worldly philosophers |

The gold standard (in economics) refers to a type of monetary system where the currency of a country is backed directly by the national gold reserves. In theory, it is possible for anyone in such a system to go to a bank and exchange a sum of money for a specific amount of gold. There is value to precious metals because as a society we have agreed that they have value, whereas paper does not have value because the gov... wait, what was my point?

The idea behind the gold standard is that it offers economic stability by limiting inflation and promoting public trust in the national currency. As such, the notion generally attracts nostalgists who want to return to the good old days. What's funny about this is that, for a bunch of market zealots, they certainly seem to be terrified of stocks or (god forbid) options, swaps, derivatives, etc. Remember, they want all that stuff to be completely and utterly deregulated. Yet they hang to the rear by investing in gold, a vanilla money market account, and some US treasuries (government DEBT!), and rushing away from stocks and other commodities. For a bunch of free market cheerleaders,[2] it seems like they're terrified of playing the free market game with them there Yankee bankers.[3][4]

Greenspan's quote, circulated frequently (and erroneously), is "Gold is the canary in the financial coal mine": Soaring gold prices is a forecast of economic insecurity. As long as traditional investments are hitting the skids, gold will continue to hold its value and probably rise. This is great news for Fast Eddie's Pawn Shop but ominous for everybody else.

History

Ancient to early modern history

In ancient, medieval, and early modern monetary systems, coins were manufactured from gold, silver and other metals because of its ability to be mass produced and standardized. Furthermore, other metals such as iron or copper had more practical uses for tools and weapons. Because gold and silver were only owned by the wealthy for many centuries, people developed a fetishized desire for the metals and believed them to have a power over others, giving them an intrinsic value in themselves (i.e. the coins were specie). Before the first millennium BCE, most economic transactions were based on credit arrangements in which resources were exchanged as gifts, with the expectation that the gift would be paid back with interest at a later date. Rare metals were kept by the temples in ingot form and used as a form of accounting, and were not used in transactions until the early iron ages. During the Axial Age (800 - 200 BCE), large scale warfare broke out among different competing states and kingdoms, fought by free peasant soldiers who plundered cities and removed stashes of gold and silver from temple stores, thus allowing the metals to be distributed among them. The first gold coins were minted in Lydia (located in modern-day Turkey) in the 500s BCE to pay the salaries of its soldiers. This form of coinage became the prototype for other ancient currencies used in places such as Persia, Babylonia, and the Greek empire.[5] States also mandated that taxes and fees must be paid in coin, making bullion widespread for the first time. Gold coinage in China was also produced during this same period, and legends say that coinage was created by the emperor to deal with a flood crisis that created a famine.[6] During the height of the Roman Empire the first widely accepted coin that had a nominal value higher than its metal value emerged[note 1], thus laying the basis for a system that differentiates between face value and token coins. However, with the decline of the Roman Empire those coins were accepted less and less and after its fall only face value coins remained in Europe. The gold coins minted by emperor Constantine (the solidus) were used widely throughout the Mediterranean and remained the currency of the Byzantine Empire until its fall.[7] During the Middle Ages, silver coinage became more popular as the Byzantine Empire declined and eventually collapsed.[8] By the 18th century, keeping coins themselves as a store of value became impractical. Increasing quantities of money in circulation, growing use of notes and bank credit, and declining resources of silver during this period were factors that led to the development of the gold standard.

Formalization of the gold standard in modern history

The first country to formally adopt the gold standard was Great Britain. The gold standard was formalized over the period of the late 17th century to the early 19th century. The British government debased its bimetallic currency toward the end of the 17th century in order to pay off debt run up during the Nine Years' War. Much of the silver coinage in circulation at this point had been clipped and counterfeiting began to increase. These factors caused a monetary crisis that led to what was known as the "The Great Recoinage of 1696."[9] The Bank of England, chartered in 1694 to provide credit to the British government, issued bank notes backed by and convertible to gold. The overabundance of credit in the form of paper currency in the late 18th century led to the suspension of the conversion of bank notes into gold from 1797-1821. Britain lifted this suspension in 1821 and returned to a formal gold standard. Other nations followed suit soon after, leading to the creation of an international gold standard.[10] The gold standard was suspended again during World War I and then reinstated, though war debts and other economic difficulties put massive amounts of pressure on the international gold standard system during the interwar period.[11]

The Great Depression to Bretton Woods

The Great Depression marked the collapse of the formal gold standard internationally. As Britain was the first to adopt the gold standard, it was also the first to leave the gold standard, doing so in 1931. The US left the gold standard in 1933, withdrew gold from circulation for everyday transactions, and devalued the dollar.[12] Many other nations followed and abandoned the gold standard.

The U.S. didn't completely abandon the gold standard during the Great Depression, though. Although private ownership of bullion gold was illegal, the price of gold was still pegged at $35 per ounce by law.

After World War II, a new international monetary system was developed known as Bretton Woods, envisioned by John Maynard Keynes and Harry Dexter White. Under the Bretton Woods agreement, the US was on a quasi-gold standard. Holding about 75% of the world's monetary gold supply allowed the US to back the dollar with gold on the foreign exchange market and honor international trade debts in gold. Other nations agreed to peg their currencies to the dollar. As the world market price of gold increased, U.S. gold stocks were undervalued at its "officially" peg price of $35 per ounce (later $42). This hampered the U.S. government's ability to collateralize debt and take full advantage of the real value of its gold stockpiles.

In what became known as the Nixon Shock, the system of fixed exchange rates lasted until 1971 when Richard Nixon closed the gold window and the Bretton Woods system came to an end.[10][note 2] The US dollar was already falling against the world gold price and since world markets were abandoning fixed currency exchange rates, no one would invest in the US without a substantial increase in interest rates. Nixon felt that allowing the gold price to inflate in line with world prices was less politically risky than doubling interest rates.[note 3]

Economics

Desire to return to a gold standard

“”An almost hysterical antagonism toward the gold standard is one issue which unites statists of all persuasions. They seem to sense - perhaps more clearly and subtly than many consistent defenders of laissez-faire — that gold and economic freedom are inseparable, that the gold standard is an instrument of laissez-faire and that each implies and requires the other.

|

| —Alan Greenspan[13] |

Some people (such as perennial Presidential contender Ron Paul and adherents to the Austrian school[14]) continue to preach in good faith that without a gold standard, money is "objectively worthless"; these people are sometimes known as "gold bugs".[15] Survivalists and conspiracy theorists often like the gold standard, as well as other precious metals like silver and platinum, because it holds out the promise of a stable currency in a governmental vacuum. The idea has also regained currency (no pun intended) recently with the ascent of the Tea Party.[16]

The general appeal of the gold standard to these groups is to wrest control of the money supply from the government. (Or the Jewish bankers, or the New World Order, or whoever your favored bogeyman is.) As Herbert Hoover said, "We have gold because we cannot trust governments."[10] Price stability is another advantage to the gold standard. Fiat currencies live with the ever-present threat that the government might print massive amounts of money, leading to hyperinflation, but such an act would be impossible with gold since the supply of gold is intrinsically limited. With fiat currency, you trade the possibility of hyperinflation for an inevitable hyper-deflationary spiral when the amount of gold ore that can be found runs out with the population continuing to increase.[citation needed]

Problems with returning to a gold standard

Not enough gold

The largest and most glaring problem in returning to the gold standard is that there is simply not enough gold in the world to cover the quantity of currency presently in existence. To put it another way, even if the US were somehow able to purchase the world's entire gold stocks (in itself an impossible proposition) there would still be nowhere near enough gold to cover the total value of dollars in existence. It is estimated that the total amount of gold that has been mined in the world is equal to about 142,000 metric tons.[17] Assuming a price of $50,000 per kilogram (corresponding to around $1550 per troy ounce), that equals about $7.1 trillion: not enough to cover all circulating money and deposits in the United States, let alone the entire world. A return to the gold standard would require a massive devaluation of the US dollar, precisely the scenario that many gold bugs feel that the gold standard would prevent.

Furthermore, this calculation only applies to the US. If all the world's other countries were simultaneously trying to do the same thing then this problem would be exacerbated. In addition, if the US were to follow the policy of buying the world's gold as outlined above then a large number of the actual dollars would have ended up overseas and the US would have the metal. Presumably, the US would then have to create more dollars for internal use, which would hardly be a counter-inflationary policy.

In addition, gold has gained several industrial uses in the last century, particularly the tech industry and some medical uses, as well as traditional uses in jewelry. The ensuing hyper-deflation of a return to the gold standard would devastate the jewelry industry (no one but the filthy rich is going to pay tens of thousands of dollars for a 14k gold wedding band, never mind 24k) and the tech industry as the extensive use of gold interconnects in chip packaging would send component prices through the roof.

Gold has little intrinsic value

Gold, aside from a few uses, obtains its value through its consumers (otherwise known as "the market"), and because the use of gold as reserve currency is more a tradition than anything else. There are a few practical industrial uses for gold, such as gold-plating electrical contacts to resist corrosion, but the demand for gold in such uses is tiny when compared with the world gold supply. Gold likely acquired its reputation as a valuable commodity for a host of reasons: it was almost impervious to corrosion in air and water, it was resistant to most acids, it was highly malleable and ductile (making it easy to work into coins), and there was an easy natural way (via touchstones) to determine its purity.

However, earlier examples of "currencies" without intrinsic value abound (feathers, shells, big fucking rocks![]() , even slices of human bone). This minimal intrinsic value of gold is at least partly recognized by non-goldbugs who are nevertheless fixated on money being backed by "something real". If hard to find and chemically inert transition metals would be a good basis for money, we could just as well set up platinum, iridium, indium, or palladium standard instead of gold.

, even slices of human bone). This minimal intrinsic value of gold is at least partly recognized by non-goldbugs who are nevertheless fixated on money being backed by "something real". If hard to find and chemically inert transition metals would be a good basis for money, we could just as well set up platinum, iridium, indium, or palladium standard instead of gold.

Strangely, silver is a better standard compared to gold: it is scarcer and has many more uses compared to gold;[18][19] silver is used in many electronic devices such as phones, calculators, circuit boards, cameras, and opticals, just to name a few.[18] It becomes even more scarce as electronics are sent to landfills.[18]

Nothing to prevent the government from leaving the gold standard

A government may choose to leave the gold standard as soon as it implements one. This is evidenced by the history of the gold standard above, in which it was suspended many times for various reasons. Therefore, the gold standard does nothing to rein in the government.

Lack of nutritional value

The standard response in a barter economy to a handful of American Eagles or Krugerrands is likely to be "sorry, can't eat gold."[note 4] In other words, the fact that gold is a shiny metal with little value besides what is assigned to it by society (in other words, one of those dreaded "fiat currencies") is consistently ignored by these people. Basically, the gold standard has the same problems as fiat currency: that gold has little practical use outside of specialized fields,[note 5] and that nearly all of its value has been assigned to it by society for its beauty and rarity.

Even assuming the survivalist dream/nightmare in which President [insert current U.S bogeyman politician here] launches his joint operation with the United Nations to herd Americans into FEMA concentration camps, gold should be far down on the list of things to stuff in the bag before fleeing to the wilds. Aside from its lack of nutritional value, gold is very dense. A single 1 oz. (troy) Krugerrand weighs just under 34 grams.[note 6] While the post-apocalyptic value of these coins (or similar quantities of gold) is unclear, it's not difficult to imagine the strain of carrying any significant quantities of gold (along with food and other supplies) while trying to evade the blue helmeted invaders. It's about as sensible as a Titanic passenger dragging a piano to the lifeboats. Short of stumbling upon camps of dentists or electronics engineers willing to exchange food, fuel, medicine or weapons for gold, one would think it smarter to have already stocked up on food, fuel, medicine, weapons, ammo, or flint to at least start a fire with. As it is, the most ardent gold bugs would likely die of starvation atop their stashes of gold.

However, as previous crises and hyperinflations have shown, people who have a steady supply of food (e.g. farmers, butchers) can make big business with gold - they take an ounce of gold for a kilo of food in the hopes that the crisis will invariably end and after it ends their gold will indeed be worth more than the food they got it for. But not in that precise moment when the people with the gold are hungry. Of course when there is a crisis with no end in sight nobody who has a steady supply or a big stash of food would trade it for something as worthless as yellow metal.

Other problems with gold coins

Physical gold coins are also very susceptible to scams. Such scams would include clipping and shaving coins, melting coins and adding in cheaper metals, and cornering the market.

Many individuals advocating for a return to the gold standard are actually running or are advertising overpriced gold selling operations (e.g. Goldline). Could it be that the politics of fear are being used by hucksters to make a quick buck? This also raises the question, if gold is so valuable to them, why are they exchanging it for "useless" fiat currency? The goodness of their hearts and desire to help the little man? That must be it.

Gold doesn't even necessarily prevent inflation

All of this being said, this does not mean that printing money (or Bushonomics/Obamanomics) is always a good thing; quite the contrary. Printing money without a sound policy to manage the money supply can devastate an already-troubled economy if people hoard the new money rather than spend it, reducing the real value of a stagnant market. However, returning to the gold standard or a fixed exchange system does not prevent inflation (see the Mexican peso crisis of 1994 and the Icelandic financial crisis of 2009), undermining the very reason the gold bugs seek to reinstate the standard. All it means is that there will be a severe and debilitating crash in the currency when the government realizes it can no longer subsidize an artificially strong currency. A well-run mint would tie the production of "fresh" currency to run slightly ahead of growth in the economy, thus keeping the money supply in a close relation to the actual wealth of the nation.

Even gold can suffer problems with inflation.[20] Gold rushes such as the California Gold Rush expanded the money supply and, when not matched with a simultaneous increase in economic output, caused inflation.[21] The "Price Revolution" of the 16th century demonstrates a case of dramatic long-run inflation. During this period, western European nations used a bimetallic standard (gold and silver). The Price Revolution was the result of a huge influx of silver from central European mines starting during the late 15th century combined with a flood of new bullion from the Spanish treasure fleets and the demographic shift brought about by the Black Plague (i.e., depopulation).[22][23] There are all sorts of other factors at play that affect inflation but they aren't tied to the currency itself. An oil shock is going to drive prices up if your economy relies on oil, which is inflationary whether your currency is backed by gold or nothing at all. This is an example of cost-push inflation.[24]

Inflation vs. deflation: Two different kinds of thieves

Another reason the gold bugs hate fiat currency is because of their belief that inflation is "theft." That is, your savings decrease in value because of the increase in money supply. This is true, but it also overlooks the fact that the gold standard tends to be deflationary and deflation could be called "theft" as well. The upper classes, while hit less hard by inflation due to their massive stocks of wealth, tend to also be creditors, while the lower classes are the debtors. Inflation is good for the debtors as it makes their debt worth less, while deflation is good for creditors, as it makes debt worth more. This was the magic of mortgage debt — up until 2008, debts shrank over time as interest failed to keep up with inflation — and was also the reason why the American populist movement in the 1890s had the free coinage of silver as one of its chief planks. Real estate, like gold, has a fixed, known quantity or supply while population (or what is the same, "demand") is ever increasing. Theoretically, the value of the asset would only increase.

A caveat, though, is that inflation is taken into account in setting interest rates (as many adjustable mortgage[25] debtors found out), so a constant inflation at an expected rate is neutral; only higher than expected inflation benefits debtors. Deflationary cycles also tend to lead to lower wages and job loss. So, overall, inflation helps people in debt and hurts people with savings or who own debt.[26]

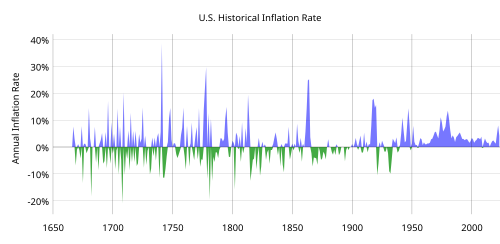

The issue of how inflation affects price stability is also important. Gold bugs like to throw around the statistic that the value of the dollar has been devalued over 98% over the last century. Of course, this is a number with no context and ignores the bleeding obvious: wages have gone up since then as well![26] If you want to go back to having your dollar worth what it was circa 1900, have fun going back to a circa 1900 paycheck too. Gold can help preserve long-term price stability to some extent, but it may actually be inferior to fiat currency in providing for short-term stability. Extreme short-term variability in price levels is not uncommon. The wild swings in prices during the late 1800s under the gold standard are one example of this.[27] In terms of price stability, then, the gold standard would be most helpful to people who prefer to stuff their money under the mattress, or bury it in a time capsule in the backyard if they are as nostalgic for turn-of-the-century currency as gold bugs are.

Historically, the upper classes and economic elite have favored hard-money conservatism while the lower classes have favored populist inflationary policy. This has led some to argue that advocating the gold standard is "class warfare" in disguise.[28] This was most evident in the US with the Free Silver movement, where populists such as William Jennings Bryan advocated inflationary policies. That's why it's rather ironic to hear hard-money conservatives in the vein of Ron Paul arguing that all inflation screws over the little guy and repackaging gold buggery in populist rhetoric, although it can be argued that the non-neutrality of money leads to monetary inflation increasing the wealth of the rich. The non-neutrality of money in the short run can allow whoever owns the printing presses (i.e., government) to channel money to itself or favored institutions or agents. This would be a case of what's called "financial repression."[29]

It should also be noted that inflation can't be employed as a panacea. It can be used to economically disastrous ends, such as the infamous case of the Weimar Republic's hyperinflation, in which it devalued its currency into oblivion in an attempt to pay off war reparations.[30] So, in short, any monetary system can be used to screw over the little guy, the gold standard included. Nevertheless, unless you're living in a nation suffering Weimar-style hyperinflation that desperately needs to anchor its currency to something, the gold bugs are firmly in crank territory.

Fun with different official and black market exchange rates

If the official exchange rate is enforced (i.e. the government will make exchanges on demand) and bi-directional (the government will buy and sell local currency at rate near the official rate), it may be exploited together with drastically different black market exchange rates:

- if the official exchange rate gets you a larger amount of foreign currency (or gold, if the exchange rate is to gold) than black market exchange rates from the same amount of local currency, buy local currency from black market rate and sell it at its official rate.

- if the official exchange rate gets you smaller amount of foreign currency (or gold) than black market exchange rates from the same amount of local currency[note 7], buy local currency at official rate and sell it on the black market.

Most hyperinflationary governments maintaining an official exchange rate will not, however, enforce bi-directional exchanges like this (for example, they only will sell local currency at the official rate and will not buy any), making the enforcement essentially nonexistent.

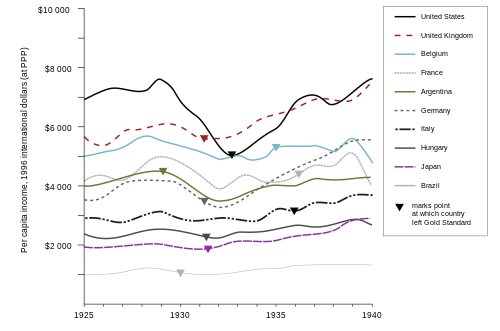

Advantages of fiat currency

The advantage of a fiat currency is in theory to match the expansion of the money supply with the expansion of economic output rather than having the money supply expand arbitrarily whenever a Yukon Cornelius 49er![]() strikes gold. This helps prevent unwanted inflation from rapid, unexpected changes in the money supply. The reverse also applies in that fiat currency's elasticity can solve problems with deflation as well. The gold standard can become deflationary during a time of economic expansion due to its inelasticity and ultimately put a damper on growth. As population, the workforce, and overall economic output grow, if the money supply under a gold standard remained static, the demand for new money would outstrip existing stocks. Hence the cost of money, and things like payrolls, would become increasingly difficult to maintain over time. An instance of this occurred during the "Long Depression" of the late 19th century.[31] This deflationary effect also played a role in the Great Depression. Nations that dropped the gold standard saw dramatic recoveries during the 1930s compared to those that didn't, which either continued to stagnate or declined slightly.[32]

strikes gold. This helps prevent unwanted inflation from rapid, unexpected changes in the money supply. The reverse also applies in that fiat currency's elasticity can solve problems with deflation as well. The gold standard can become deflationary during a time of economic expansion due to its inelasticity and ultimately put a damper on growth. As population, the workforce, and overall economic output grow, if the money supply under a gold standard remained static, the demand for new money would outstrip existing stocks. Hence the cost of money, and things like payrolls, would become increasingly difficult to maintain over time. An instance of this occurred during the "Long Depression" of the late 19th century.[31] This deflationary effect also played a role in the Great Depression. Nations that dropped the gold standard saw dramatic recoveries during the 1930s compared to those that didn't, which either continued to stagnate or declined slightly.[32]

Ironically for libertarian advocates of the gold standard, Milton Friedman famously argued that the gold standard was a major factor in causing the Great Depression, contributing to the contraction of the money supply in 1929-1933.[33] The broad thrust of Friedman's argument is now conventional wisdom among economists and historians across a variety of schools of thought, though disagreement may exist on just how big a role gold played in the Depression.[34]

Another advantage of fiat currency in depression situations is that government spending is often used to help stimulate the economy during a recession. With a gold standard the government would not have the ability to spend more money than it is taking in, to put money in the economy to help it recover. This would likely lengthen recessions as the government would lose one of its most important tools to help a shrinking economy.[35]

Likewise, if the international trading system demanded trade accounts be settled in gold, the United States with its huge trade deficit would be paying for imported crude oil in gold. As well as interest on Treasury debt held by foreigners. And foreign manufactured consumer goods. This would lead to a massive contraction in the money supply, a deflationary spiral, unemployment, shortages of cash and cash equivalents, and would probably ultimately end in conversion back to a fiat currency anyway to relieve the misery, poverty, social unrest, and political instability that would result.

Paper money (backed by a sensible government) has an advantage over gold in that, while being intrinsically worthless, it is at least cheap to make, as opposed to gold which is intrinsically worthless and requires a massive mining and smelting infrastructure to extract and form into ingots which then do nothing but sit in vaults for the rest of eternity. This is why most developed countries have similar "floating" currencies, and it is only in the developing world that "fixed currencies" still exist, though most of those are fixed to the dollar, not to gold. (Even so, in many of those, such as Zimbabwe and North Korea as well as the former governments of the old Soviet bloc, there are official exchange rates and black market exchange rates.)

Pseudolaw: Fake constitutionality

Gold bugs will sometimes use a pseudo-legal argument that only the gold standard is Constitutional, citing this clause:

“”The Congress shall have Power To coin Money, regulate the Value thereof, and of foreign Coin, and fix the Standard of Weights and Measures; No State shall make any Thing but gold and silver Coin a Tender in Payment of debts.

|

This is a combination of two passages from the constitution.[36] The first clause: "To coin money, regulate the value thereof, and of foreign coin, and fix the standard of weights and measures;" is Article I, Section 8, Clause 5. The second clause is found in another section entirely, referring to restrictions on the states, not Congress. It is Article I, Section 10, Clause 1, which reads: "No state shall enter into any treaty, alliance, or confederation; grant letters of marque and reprisal; coin money; emit bills of credit; make anything but gold and silver coin a tender in payment of debts; pass any bill of attainder, ex post facto law, or law impairing the obligation of contracts, or grant any title of nobility."[37] Apparently, some people think that this prohibits fiat money. However, the quote says the exact opposite: It explicitly grants the federal government the power to coin money. The restriction to gold and silver applies solely to state governments.

These passages refer to the the concept of 'Legal Tender,' which varies around the world but does not generally refer to the types of coins and banknotes that can be used for monetary exchanges, but the amounts of each denomination of note or coin that can be combined together for payment of court ordered debts[38]. This means that stories of people beating the system by paying debts using wheelbarrows of small change may be exaggerated and has little or no bearing on which currencies are constitutional regarding private sales.

The rhetoric and moralism of gold

The issue of the gold standard, like all monetary issues, has as much to do with morality and philosophy as it does economics. As above, libertarian proponents of the gold standard often frame the issue in terms of government "corrupting" our money.[39] During the 19th century (and still today), a rhetoric of a superior morality surrounded gold. Gold was thought to be a sign of thriftiness and integrity. It was even sometimes referred to as "God's money." There was also a racial tinge to the rhetoric surrounding gold: In some segregated industries, white workers were paid from the "gold roll" while black workers were paid from the "silver roll."[40] Karl Marx noted this rhetoric as an example of his concept of "commodity fetishism," writing that both gold and paper money become "the direct incarnation of all human labor."[41] (Indeed, Marx might have said that capitalism merely replaced gold fetishism with paper fetishism if he had lived to see the 20th century.) Barry Eichengreen and Peter Temin argue that this "gold mentalite" was a factor that worsened the Great Depression due to policy-makers clinging to the gold standard despite its failure.[42]

Opponents of the gold standard and proponents of paper or fiat currency similarly used rhetoric with moralistic and religious overtones. As William Jennings Bryan said in his speech to the Democratic National Convention in 1896: "Having behind us the commercial interests and the laboring interests and all the toiling masses, we shall answer their demands for a gold standard by saying to them, you shall not press down upon the brow of labor this crown of thorns. You shall not crucify mankind upon a cross of gold."[43] John Maynard Keynes wrote in his book Monetary Reform: "In truth, the gold standard is already a barbarous relic."[44] The Greenback Party (active from 1875-1884), a third party that advocated the replacement of the gold standard with the paper "greenback" currency used to finance the American Civil War, often had themes of salvation running through its propaganda.[45][46] When the St. Gaudens design for the $20 gold double eagle coin started being minted in 1907, president Theodore Roosevelt insisted that it not carry the motto In God We Trust, because he felt it was irreverent to put God on our money. (Congress overturned this within the year.)

The Murabitun World Movement, an Islamic movement founded in Spain by Abdalqadir as-Sufi![]() (Ian Dallas), is "possibly the only religious sect in history whose defining article of faith is a financial theory."[47] Their principle tenet is in restoring zakat (Islamic obligatory alms-giving), but requiring that the zakat be in the form of gold (e.g., modern gold dinar

(Ian Dallas), is "possibly the only religious sect in history whose defining article of faith is a financial theory."[47] Their principle tenet is in restoring zakat (Islamic obligatory alms-giving), but requiring that the zakat be in the form of gold (e.g., modern gold dinar![]() ) or silver.

) or silver.

See also

- Bitcoin: An attempt to bring the gold standard into the virtual world.

- Federal Reserve: sometimes presented as part of a conspiracy for the "elite" to control the world via fiat currency.

- Sound money

- Terry Pratchett, who lampooned goldbuggery and the shiny stuff's lack of intrinsic value in his 36th Discworld novel, Making Money

(2007).

(2007).

External links

- Gold Standard, EH.net Encyclopedia

- Gold Standard, Encyclopedia of Money

- The Gold Bug Variations, Paul Krugman

- Gold vs. Chickens, CBC

- Room for Debate: Back to a Gold Standard? New York Times

- The Gold Standard of Lunacy, The Aporetic

- Barry Eichengreen. A Critique of Pure Gold. National Interest, Sep-Oct 2011.

- Craig K. Elwell. A Brief History of the Gold Standard in the United States. Congressional Research Service Report, Jun. 23 2011.

- See the Wikipedia article on Bimetallism.

- See the Wikipedia article on Silver standard.

Notes

- ↑ Namely the Sestertius and the smaller As

- ↑ As the U.S. moved from a Trade Surplus nation, largely due to the Marshall Plan, to a Trade Debtor nation with its increasing reliance on imported foreign crude oil, the outflow of gold under the fixed exchange rate system threatened to dry up U.S. gold reserves. Hence the "closing of the gold window".

- ↑ He was most likely right as evidenced by his easy reelection in 1972 (though of course we now know he had help)

- ↑ Well, technically, you can eat gold. It has no taste or nutritional value, but eating it is pretty much harmless. Except for chrysiasis — that's like argyria but more expensive.

- ↑ As noted, gold is used in electronics and in dental work for its properties of corrosion resistance and electrical conduction. But gold teeth and parts in computers which could be replaced with cheaper metals doesn't really justify use as a standard for a major monetary system.

- ↑ Strangely enough, about a troy ounce. 1.09 oz. troy to be exact, the extra 0.09 oz. being copper.

- ↑ Chance that this will happen is slim to none, but just included for the sake of completeness

References

- ↑ My Friendly Debate On The Gold Standard With Allan Meltzer, The World's Leading Monetarist. Forbes.

- ↑ Charles Postel, "Why conservatives spin fairytales about the gold standard", Reuters.

- ↑

Jeff FoxworthyJoshua M. Brown, "You Might Be a Goldbug if...", The Reformed Broker. - ↑ Amanda J. Crawford, "Trust in Gold, Not Bernake", Bloomberg.

- ↑ Lydian coins, Ed Snible

- ↑ 2400 Years of Chinese Coins and Currency, Joel Anderson

- ↑ Solidus, Encyclopedia Britannica

- ↑ Silver, Encyclopedia of Money

- ↑ Charles Larkin. The Great Re-Coinage of 1696. Developments in Monetary Theory, 25 Sep. 2006

- ↑ 10.0 10.1 10.2 The Gold Standard Revisited, Investopedia

- ↑ Leland Crabbe. The International Gold Standard and U.S. Monetary Policy from World War I to the New Deal. Federal Reserve Bulletin, Jun. 1989

- ↑ Jun 5, 1933: FDR Takes the US Off the Gold Standard, This Day in History, history.com

- ↑ Gold and Economic Freedom by Alan Greenspan. Published in Ayn Rand's "Objectivist" newsletter in 1966, and reprinted in her book, Capitalism: The Unknown Ideal, in 1967. Constitution Society.

- ↑ See Murray Rothbard's "The Case for a 100% Gold Dollar" for the Austrian arguments.

- ↑ Gold Bug definition, Investopedia

- ↑ Pushing for a Return to the Gold Standard, Los Angeles Times

- ↑ Mineral Commodity Profiles — Gold by W.C. Butterman and Earle B. Amey III (2005) U.S. Geological Survey. Open-File Report 02-303.

- ↑ 18.0 18.1 18.2 Silver is Now Rarer than Gold: $100 Silver Now a Conservative Target by Luke Burgess (July 12, 2011) Wealth Daily.

- ↑ World has 5 times more gold than silver by Vivek Kaul (Updated: Mar 3, 2009, 03:57 AM IST) DNA India.

- ↑ Why the Gold Standard is the Worst Economic Idea in 2 Charts, Matthew O'Brien, The Atlantic

- ↑ California Gold Rush, Robert Whaples, EH.Net Encyclopedia

- ↑ Peter Kugler and Peter Bernholz. The Price Revolution in the 16th Century: Empirical Results from a Structural Vectorautoregression Model. WWZ/University of Basel working papers

- ↑ Adam Smith, Wealth of Nations, Bk I, Ch 11, paragraph 17.

- ↑ What Is Cost-Push Inflation? about.com

- ↑ Adjustable Rate Mortgage

- ↑ 26.0 26.1 Inflation for the People, Noah Smith

- ↑ Michael D. Bordo, Robert D. Dittmar, and William T. Gavin. Gold, Fiat Money and Price Stability. Federal Reserve Bank of St. Louis Working Paper Series, Working Paper 2003-014D

- ↑ What's Behind the Right Wing's Bizarre Obsession with the Gold Standard? AlterNet

- ↑ Carmen M. Reinhart, Jacob F. Kirkegaard, and M. Belen Sbrancia. Financial Repression Redux. Finance & Development, June 2011, Vol. 48, No. 1

- ↑ As We Go Marching, John Flynn, pp. 91-92.

- ↑ The Gold Standard, Deflation, and the US Historical Record, Elliot Parker, University of Nevada, Reno

- ↑ The Gold Standard and the Great Depression, James Hamilton, EconBroswer

- ↑ Milton Friedman and Anna Schwartz. "The Great Contraction." Ch. 7 in A Monetary History of the United States, 1867-1960, pp. 299-407.

- ↑ Barry Eichengreen and Peter Temin. The Gold Standard and the Great Depression. Contemporary European History, 9, 2 (2000), pp. 183-207

- ↑ The effectiveness of fiscal and monetary stimulus in depressions, Vox EU

- ↑ Debunking gold standard myth, Now Public

- ↑ Article I of the Constitution, Cornell University Law School

- ↑ Legal Tender(United States), Wikipedia

- ↑ See, e.g., Rothbard's What Has Government Done To Our Money?

- ↑ The Rhetoric of the Gold Fetish, The Aporetic

- ↑ Dino Fellugo. "Modules on Marx: On Fetishism." Introductory Guide to Critical Theory, Purdue University

- ↑ Barry Eichengreen and Peter Temin. The Great Depression and the Gold Standard. NBER Working Papers Series, working paper #6060, Jun. 1997

- ↑ Bryan’s “Cross of Gold” Speech: Mesmerizing the Masses, History Matters, George Mason University

- ↑ John Maynard Keynes, Wikiquote

- ↑ Greenback Labor Party, Spartacus Educational

- ↑ A contemporary political cartoon depicting the Greenbacks worshiping a "paper jackass."

- ↑ In Gold We Trust. From gun-wielding libertarians to radical Muslims, an unlikely global cabal is plotting financial revolution. And they're putting their money where the Web is. by Julian Dibbell (01.01.02; 12:00 pm) Wired.